In this post, Matt Lasky, Managing Partner at Equity Velocity Funds shares how investors can evaluate past performance and 5 takeaways for investing in today’s market.

—

The commercial real estate industry has experienced a period of solid returns. There is increasing interest in the asset class given its non-correlation to public securities, lessened volatility, and ability to out-perform as evidenced by endowments like Yale, who have outperformed their peers and have heavy allocations to alternative assets. We’re in an environment where interest rates are low, asset values continue to increase and have surpassed previous peaks, resulting in a favorable time to exit assets. Given some of the headline grabbing returns that are tossed around boasting high IRR’s and equity multiples, it brings up the question, “how should I evaluate performance and invest moving forward?”

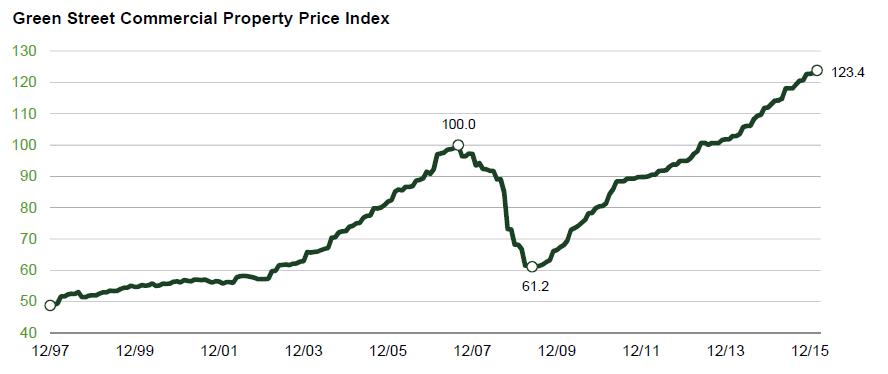

Before we dive into the above question, I wanted to share some data. Below is the Green Street Commercial Property Index over time showing All-Property values.

One can see that property prices have consistently increased over the last 5-7 years. This means if a manager purchased in that time period and kept the asset in similar condition, substantial returns would be achieved. Below is an example using strip center data from the NREI report. The average cap rate in Q1-2011 was 8.53% whereas in Q1-2016 that same number was 6.84%. Let’s look at the below example that utilizes the average cap rates as entry and disposition cap rates:

The above isn’t illustrative of front-end transaction costs, any costs associated with operating the property, or promote structures, but still demonstrates the power of market timing and shows the large effects that even a modest NOI increase may have. A 10% NOI increase over 5-years could be reflective of just regular contracted rent growth and not necessarily attributed to an investment manager driving NOI value. These returns demonstrate performance that would excite most investors but are more of a reflection on when the investment was made as opposed to driving asset value.

Today investors are purchasing assets in an environment where the average pricing is at a peak. Given a host of other macroeconomic factors, many feel real estate is still favorable, but if we are in agreement that there won’t be appreciation in pricing due to investor sentiment (cap rate compression), how can investment managers still achieve outsized returns? Good investors in the value-add and opportunistic space purchase assets at the right price that have issues they can solve, which result in increases to the net operating income while limiting downside risk. These issues can be related to poor capital structure, physical issues with the asset, improving property operations, or a combination of the group.

In today’s environment, I think it is more prudent than ever to ask groups you may be investing with for case studies and past deal history. In particular, understanding what their original assumptions were going into past deals and how they fared, looking deeper than just IRR and Equity Multiple metrics to include tangible increases of how they drove increases to the net operating income. Potentially more important than the deals that went well are the ones that didn’t go as planned and understanding the “why” and how the manager overcame obstacles can tell you a lot about the character of them. This is of critical importance for the reasons Joe outlined in his post “When Investing in Real Estate Invest with the Best Sponsor and Ignore Everything Else.”

I don’t have a crystal ball telling me where asset prices are headed, but given the power of investing at the right time that was demonstrated above, I think we’re at a part in the cycle where one should scrutinize those that they are investing with to understand how returns are being generated. If returns relied more on purchasing at the right basis and time versus creating significant NOI increases, it may be a strategy to be more cautious of moving forward given where asset pricing currently is.

5 takeaways for investing in today’s market:

- Understand how the investment manager has historically added value and achieved returns. Look for significant NOI increases if you’re evaluating value-add and opportunistic investment history.

- Inquire about performance throughout the last cycle or two and deals that haven’t gone as planned. Make sure you understand how the investment managers carry themselves when things don’t go as planned and handles legacy asset issues.

- Ensure that whomever you invest with has an alignment of interests and “skin in the game.”

- Look at downside scenario’s where the asset may sell at a higher cap rate, lease-up may be slower or not achieved at the pro-forma’d rents, and make sure if the debt is floating rate that you’re looking at some sort of interest rate increase over the investment period.

- Consider alternative investment strategies in real estate such as:

- Yield plays where there is good cashflow on “A” quality assets.

- Business plans that may have a longer time horizon 7-10 years and could ride out a cycle.

- Deals where the investor is achieving some relative pricing advantage due to relationships, speed to market, dislocation in pricing, secondary/tertiary markets or all of the preceding.

Have any questions or want to start a dialogue? E-mail me: [email protected]

Matt Lasky is a Managing Partner at Equity Velocity Funds, a leading boutique real estate private equity fund with an emphasis on value-add and opportunistic healthcare & retail assets. He is responsible for deal sourcing, structuring, and analysis. Post-acquisition, Matt helps implement the strategic business plan on each asset to enhance its value. He has been involved in $1+ Billion of Commercial Real Estate transactions and consulting engagements. Matt graduated cum laude from Miami University with a degree in Finance and emphasis on Business Analytics.