2021 has been a crazy year and it’s difficult to comprehend what’s going on.

Take the multifamily industry for example. When I speak with people outside commercial real estate, they’re shocked when I tell them about the historically high rent growth and occupancies we’re experiencing today.

With COVID issues lingering, relatively high unemployment, and “everyone they know buying homes”, most people assume the multifamily market is struggling. As we all know, that’s not the case. In fact, the opposite is true; apartments are experiencing unprecedented levels of demand leading to record-setting rent growth figures and record-low vacancies.

The National median rent increased 16.4% since January (according to Apartment List) and that figure was much higher (north of 20%) in many high-growth Sunbelt markets. The annual demand volume as of Q3 was 600k units, well past the previous economic cycle peak absorption of 380k units. The Q321 absorption was 180k units alone which has pushed the national vacancy rate is at an all-time low of 4.5%.

The chart below illustrates the net absorption (yellow bar) and vacancy (green line) in 2021. It’s off the charts (figuratively)!

While the national story is wild, things are even crazier across much of the Southeast. Below is a chart of year-over-year lease trade outs for Q3 on a few of the class B garden style communities we own in Florida; 30%-50% rent growth in Q3!

Not surprisingly, 9 of the top 10 rent growth markets in the country were located in the Southeast.

So what’s driving such crazy rent growth? There’s a perfect storm of supply/demand factors; job growth, household formation, pent-up demand, limited new supply, competitive housing market, and other tough to measure factors such as gov’t stimulus and remote work.

Job/Wage Growth

The U.S. is continuing to add jobs. The U.S. added 1.09M jobs in July, 366k in August, and 194k in September, lowering the unemployment rate to 4.8%. No matter how you look at it, that’s a lot of jobs added in a short period of time.

At the same time, we have a labor shortage which is putting upward pressure on wages. Year-over-year, wages are up 4.6%.

While the economy certainly isn’t humming and we’re still far from pre-pandemic employment levels, we have a lot more people working today with incomes rising, spurring demand for apartments.

Household Formation

During the pandemic, many recent graduates and young people moved back in with their parents. However, as the economy has bounced back, many of those young people are moving into their own apartments. Afterall living at home is less than ideal, especially for the parents.

Today, 34% of young adults (24.9 million) live with their parents. This is 5.1 million above the long-term average, so we have room for more growth.

Apartment owners are effectively experiencing two years of demand in one year. Stimulus, a high savings rate, and growing job market will lead to additional household formation.

Relatively Limited New Supply and Underbuilding

We’ve been underbuilding housing (apartments and single-family) for a long time. Developers are on pace to deliver 1.5M housing units (single-family + apartments) in 2021, but on average, we need to build 1.8M units per year to keep up with demand (Costar).

Developers want to build more multifamily units, but higher input costs (land, materials, labor), supply chain disruptions, and delayed approvals are holding back supply. Therefore, supply is not keeping pace with demand.

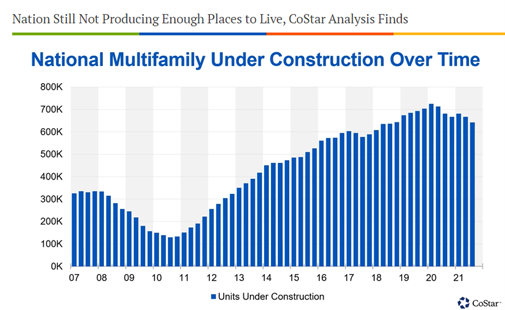

While the number of apartments under construction has been accelerating since the low in 2010, in Q321 the number of units under construction fell by 80,000 units.

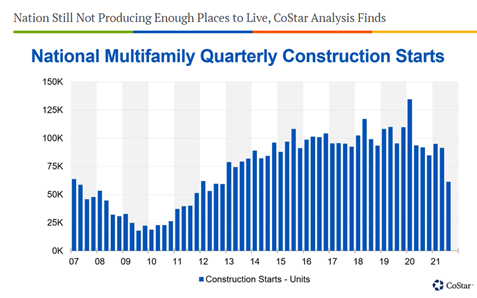

Additionally, construction starts are slowing due primarily to rising construction costs and supply chain constraints which don’t seem to be dissipating anytime soon.

We simply aren’t building enough new housing to keep pace with demand.

Unaffordable Housing Market

I hate generalizing about the housing market given that everything is market-specific, but I think we can all agree that a 20% gain for national home prices in a one-year period will create affordability issues. House prices are rising at a record pace, but incomes aren’t keeping up, which is making homeownership less affordable.

According to the Atlanta Fed, the median American household would need 32% of its income to cover the mortgage payment on a median-priced home. This is the most since November 2008, when that figure was 34%.

Rising home values also mean that prospective homebuyers need to come up with more for a down payment, which I think is the primary challenge for most young people in the market for a home.

I want to be clear that housing is not unaffordable everywhere in the U.S., but on the coasts and markets throughout the Southeast like Atlanta, Nashville, Charlotte, and Tampa, many first-time homebuyers are priced out and forced to stay in the renter pool.

Remote Work

It’s hard to measure, but there is no doubt that the rise in remote work is driving additional demand for apartments. Remote workers have the flexibility to live wherever they like and can choose from any number of short-term rental platforms.

—

When you add all these factors up, it’s no surprise that apartment owners are experiencing record demand today.

So what could slow the wave of multifamily demand?

- Oversupply in select markets: While supply is generally constrained nationally, there are select markets which are experiencing significant new supply as a % of existing inventory, which could put downward pressure on rents and occupancies in those markets.

- Competition from build-for rent single-family houses and townhomes: There’s $30B of dry powder chasing the single-family rental space. With Millennials starting families, but with many priced out of the housing market, single-family rentals are an attractive alternative.

- Rents outpacing wage growth: Is there sufficient demand (i.e. population with sufficient paying jobs) within the local market to sustain the higher rents? For example, we’re signing leases north of $2,000/mo. at an 80’s vintage deal in Sarasota when in-place rents are $1,350/mo. A vast majority of our residents could not afford today’s market rent.

For now, it’s a golden era for apartments and owners should make hay while the sun shines.